- Published on

Embarking on the Path to Financial Freedom

Why Create This Investment Portfolio?

The establishment of this investment portfolio is entirely because I felt it was necessary to document my investment thought process, to remind myself where I have stumbled in the past. People tend to forget their mistakes easily, but record my thoughts at the time in writing. Whenever I revisit them, it may bring unexpected gains. So, how should I establish this investment portfolio? I pondered this question for a long time. Returning to my original intention for creating this portfolio, why did I want to build it? I said to myself, "Because I want to record my investment process, right or wrong, truly capturing my thoughts and practice. I also want to verify that an ordinary person can gradually become wealthy by learning Warren and Charlie's philosophy." With this as the main idea, I listed three requirements for this investment portfolio:

- Adhere to Warren and Charlie's investment philosophy.

- A completely independent and authentic account for easy record-keeping.

- A starting fund that most people can achieve, to witness the power of compound interest.

At the same time, I happened to find an account with about $10,000 in stocks—was this an arrangement from God? Thus, the origin of this $10,000 personal investment portfolio came to be.

Although the investment funds are not large, it does not mean that speculation is permissible in the stock market. The amount does indeed affect investment choices, but the investment philosophy remains unchanged. It's not that small money can be used for speculation in the market, while large money can only be used for value-based investment. Everything is relative, small capital has its advantages, and large capital has its troubles. I hope one day you will understand this statement.

Portfolio Concept

The concept of this investment portfolio comes entirely from my understanding of Warren and Charlie's philosophy: to buy the stocks of excellent companies at a reasonable price and accompany these enterprises as they grow. Of course, if there are suitable arbitrage opportunities, I will participate appropriately. I am well aware of my limited capabilities; even after long-term study and some understanding of their investment philosophy, it does not mean I can do well. But just as Warren always remains optimistic about the future, I am also full of hope for myself.

Portfolio Position Establishment

| Exchange | Symbol | Date | Quantity | Price | Amount | Exchange Rate |

|---|---|---|---|---|---|---|

| HKEX | 00700 | 2023/06/29 | 100 | 332.200 HKD | 33,220.00 HKD | |

| HKEX | 00700 | 2023/09/26 | 100 | 301.600 HKD | 30,160.00 HKD | |

| NYSE | BABA | 2024/03/27 | 20 | 70.53 USD | 1,410.60 USD | |

| Sum | 9523.24 USD | 1HKD = 0.128USD |

This is the record of the stocks purchased in this account. Why start from 2023? Because I started researching Tencent in 2022, and the more I researched, the more I realized that Tencent is indeed a great company, fully meeting the three criteria of Warren's investment philosophy that I understand: a good company, an excellent management team, and a good price. Alibaba's certainty is not as strong as Tencent's, but it is also a good company, and with a very low valuation, the margin of safety is sufficiently large.

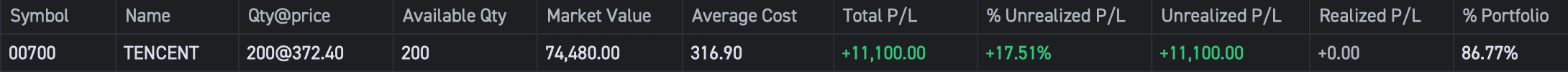

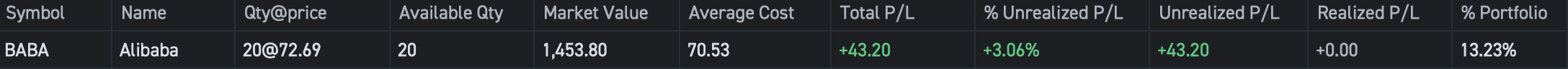

The above is the actual income of the two stocks I hold. Tencent occupies my main position, and this proportion is indeed too large; generally, it is recommended that individual stocks should not exceed 40% of the investment portfolio. This is indeed a limitation of small capital, but good companies do not often have good prices. When the certainty is high enough, be brave to bet. As Warren said, "If you have only '20 punch positions' in your life, how would you invest?" That is, hold a few excellent stocks and wait for the market to pay for your hard work.

Why Choose These Two Stocks?

Tencent is a company I have been studying for a long time, and I can understand its business model. In China, there are very few excellent companies that I can understand; excellent companies are rare worldwide, and I am fortunate to have found one in China.

Alibaba came to my attention because of Charlie's purchase. Charlie said it was a wrong choice, overestimating Alibaba's leading position in the Chinese market and describing it as ultimately just another damn retail business. Through my understanding of Alibaba, I do not think Alibaba has started to decline. Alibaba does face significant pressure in China; Alibaba Cloud faces challenges from giants like Tencent and Baidu, and its main e-commerce business faces fierce competition from Pinduoduo. But its position in China is still unparalleled, and after a substantial drop in stock prices, the margin of safety is already very large, so I bought Alibaba.

With the outbreak of AI, I firmly believe that the future of AI is boundless. However, the development of AI depends most critically on having application scenarios and data. Tencent and Alibaba are the top two internet companies in China, with a vast number of users and a massive amount of data. Therefore, they have enough scenarios to implement AI. I don't know when it will be realized, and I don't want to predict these things because it's not very meaningful. I just need to know that in China, in addition to death and taxes, there are Tencent and Alibaba. If even they cannot develop AI, I find it hard to believe that other companies can achieve better results.

In The End

Investment will accompany me throughout my life. I am fortunate to have found a career I love. I also hope that this investment portfolio can record my growth and achieve it; who doesn't want to become richer? On this platform, I also hope to make like-minded friends and grow together with everyone through communication, learning, and growth. I believe that investing can make a lot of money, which is also beyond doubt. I look forward to gradually becoming wealthy together with everyone!